Transfer of equity is the process of transferring shares or ownership of a company to another entity. Typically, this involves the exchange of assets such as cash, stocks, and other securities in return for a stake in the company. With the transfer of equity being such a critical facet of business, there is of course an intricate process to follow when it comes to redistributing the ownership interests. Here’s what you need to know about it.

Valuation and Negotiation

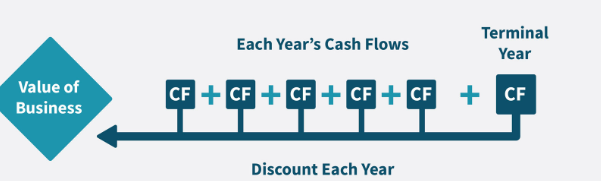

First off, before any transfer of equity can begin, the company’s perceived value or the equity of the stake needs to be determined. The most common valuation techniques include comparable company analysis and discounted cash flow analysis. The chosen valuation method for each company can vary due to factors such as the company’s financial performance, market conditions, and trends in the industry.

Once the company’s value has been established, the terms of the transfer then need to be negotiated. This includes the amount of the transfer and the conditions attached to it.

Navigating Legal Compliances

As with any business transaction, it’s paramount to ensure compliance with relevant laws and regulations. To ensure successful compliance, all companies going through a transfer of equity should draft legal documents detailing the share of transfer agreements.

Assess the Risks

Both buyer and seller need to conduct due diligence to assess the risks associated with the transfer. This typically involves reviewing financial statements and contracts. If both parties are happy that the perceived opportunities outweigh the risks, the transfer of equity can go ahead. If the transfer is found to carry more risks than benefits, the transfer of equity is discontinued.

Closing the Transfer and Integration

Once both parties have agreed they’re happy with the transfer, the transaction is then documented and legalised. The funds are transferred and filed with the local authorities. Once the transaction has been closed, the equity of ownership has legally been bound to the buyer. After this, a period of integration follows in which both parties work together to integrate their respective acquired assets into their existing operations.

Understand Equity Transfer for a Brighter Business Future

Understanding the intricacies of the transfer of equity costs is essential for businesses looking to navigate ownership succession. For any business looking to seek or transfer ownership, it’s important to obtain expert advice beforehand from a specialist such as https://www.samconveyancing.co.uk/news/conveyancing/transfer-of-equity-cost By doing so, you’ll ensure a smoother transfer of equity.

The process of equity transfer entails transferring the ownership or shares of a company from one entity to another. Typically, this endeavour involves a process of valuation and negotiation, legal compliance, assessing risks, ending with finalising the transfer.

+ There are no comments

Add yours