Let’s think about applying for a mortgage for a moment. What are the main things that you need to have in place before you can begin? Here is a very simple run through of the essential things that you will need to have.

- A mortgage promise. In the first instance this is what you start with. A mortgage promise is what the lender gives you as an initial indication as to what they can lend you. This will give you an idea of the price that you can go for.

- Have a deposit. In many ways this should be before the Mortgage promise as there are no 100% mortgages anymore (although that might change) and the minimum you will need is 10% of the house’s purchase price. Whether you have saved it, been gifted it or you are using the money from your current home or another house a deposit is key.

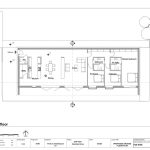

- Have a place in mind. Rather than just setting out into the market it’s a good idea to form a plan around what kind of new home you are looking for, is it space you need or a better garden.

- Conveyancing Solicitors Near Me. You will need a solicitor for the later stages of the purchase so get one as soon as you can. A local one like Sam Conveyancing is a great idea.

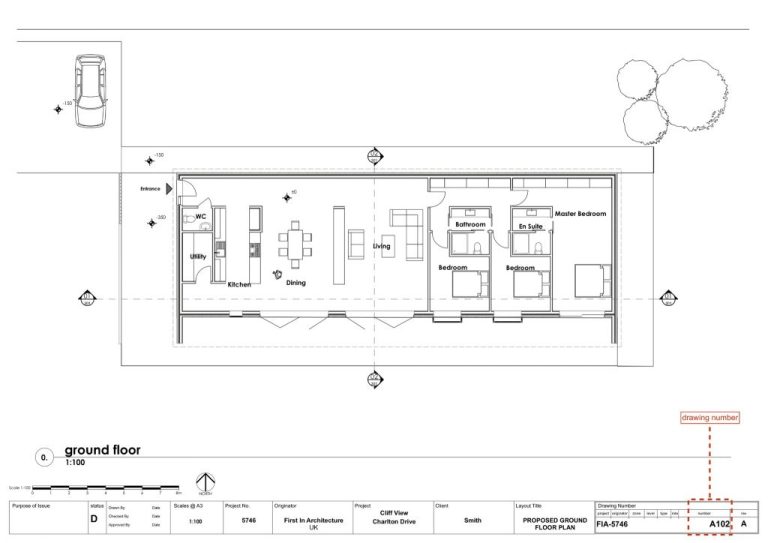

- Look at the cost of a valuation or homebuyers report. This greatly depends on the age of the property. Most lenders make you use their own valuers as they trust them but you can choose the level that they go to.

+ There are no comments

Add yours